Nvidia Corp.’s stock fell short of closing with a $1 trillion valuation despite flirting intraday with levels that would have helped the chip giant achieve the milestone.

Shares ended Tuesday’s session at 401.11, giving the company a market capitalization of $990.7 billion. They needed to close at $404.858 or above in the regular session for Nvidia

NVDA,

to achieve a market capitalization upwards of $1 trillion, according to Dow Jones Market Data. The shares touched an intraday high of $419.38 in Tuesday’s action.

Only six U.S. companies — Alphabet Inc.

GOOG,

GOOGL,

Amazon.com Inc.

AMZN,

Apple Inc.

AAPL,

Meta Platforms Inc.

META,

Microsoft Corp.

MSFT,

and Tesla Inc.

TSLA,

— have closed in $1 trillion territory.

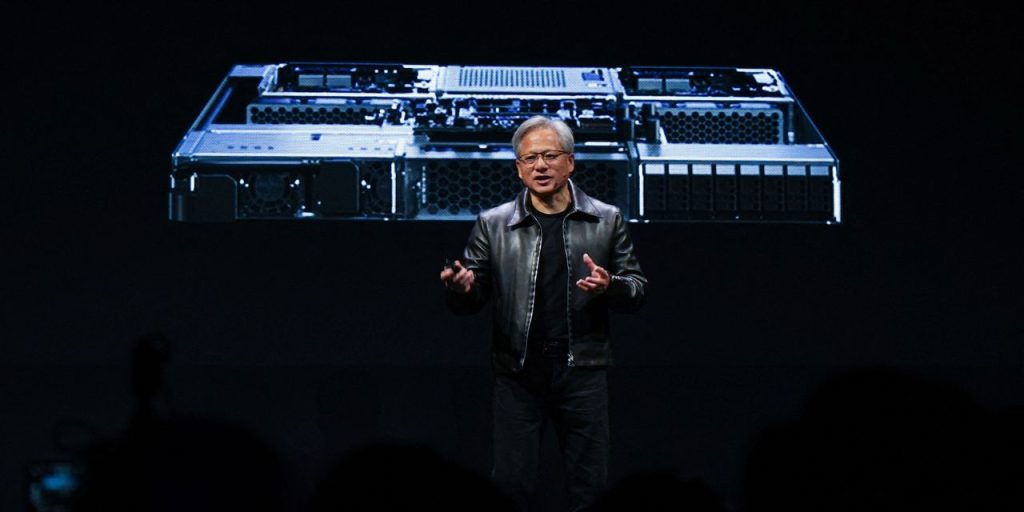

Nvidia’s stock gained 3% Tuesday following product announcements a day earlier, including its new Grace Hopper supercomputer and its first ethernet networking offering. These showed that Nvidia is “not standing still” but rather “running as fast as [it] can and extending [its] already dominant lead,” according to Evercore ISI analyst C.J. Muse.

Read: Wall Street tech darling Nvidia unveils more AI products — including a new supercomputer

While Nvidia teased the ethernet debut on its last earnings call, Wells Fargo analyst Aaron Rakers noted that the announcement illustrated Nvidia’s “deepening enterprise strategy” with a product the company says will help in the deployment of generative artificial intelligence, the type of AI popularized by ChatGPT.

More from MarketWatch: Nvidia CEO tells graduates to take advantage of AI or get left behind

The stock’s Tuesday rally built on a year-to-date surge that hit high gear last week as Nvidia stunned Wall Street with its expectations for how AI-fueled demand for its data-center products would translate into financial performance. The company vastly exceeded consensus expectations with its revenue forecast for the current quarter, helping to send shares up 24.4% in a single day last week.

Don’t miss: ‘Unprecedented’ and ‘unfathomable.’ Nvidia makes jaws drop on Wall Street as stock explodes higher.

Nvidia shares are now ahead 174% so far this year.

Rosenblatt Securities analyst Kevin Cassidy wrote in a weekend note that Nvidia’s forecast, which implies 50% sequential growth for the July quarter, is one of the “historical and defining moments of a significant cycle which we view as secular and call the Mother of All Cycles.” Marvell Technology Inc.’s

MRVL,

outlook was another key moment in that narrative, according to Cassidy.

Read: Marvell stock rockets more than 30%, its best day ever — is it the next hot AI play?

Read the full article here