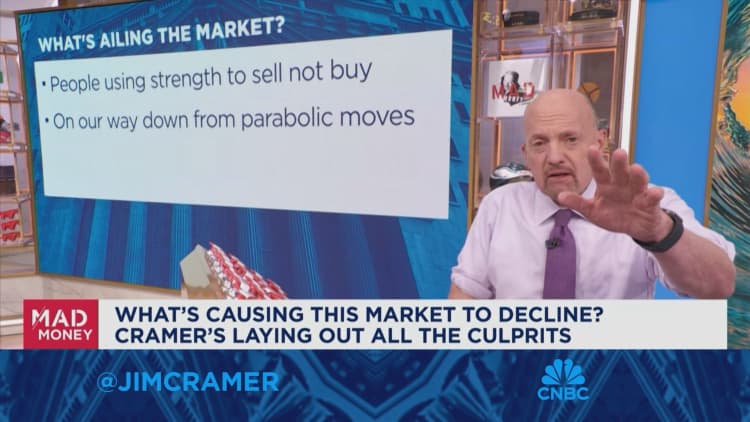

After the major indexes pulled back on Wednesday, CNBC’s Jim Cramer explained what might cause the market to continue to decline. He also advised investors not to buy or sell all at once

“If you want to get out, go ahead. But I would say that the time to sell was when the market was going parabolic,” he said. “The time to buy is when the parabola finishes, comes down dramatically. We don’t know when that moment will come yet, but at this point, you sure aren’t buying at the top.”

The major indexes all notched losses by Wednesday’s close, with the S&P 500 dipping for a fourth consecutive session. Stocks opened high, but declined as the day went on, brought down by losses from Big Tech names like Nvidia, Apple, Meta and Microsoft.

Cramer noted that many stocks have had “parabolic moves,” saying that they’ve rallied straight up like a parabola, and now are coming back down. But he said it may not be time to buy aggressively because the market is “not yet oversold given where we’re coming from.” He also added that the economy is too hot for the Federal Reserve to start cutting rates, as many on Wall Street had hoped for.

He suggested that the market can tell you when a huge wave of selling is finally coming to an end.

“Usually, you’ll get a day when the market starts down, not up like it did today, down big, therefore it gives you a chance to get in after the wash out,” Cramer said. “An up start like we had today is a nightmare. You need to wash out all these people before you can bottom, and we’re not near that yet.”

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Nvidia, Apple, Meta and Microsoft.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? [email protected]

Read the full article here