The U.S. banking system is strong and reliable. The industry is well regulated, and one of the results of the FDIC insurance program is that retail depositors should never have to wonder about the financial strength of their chosen bank. The FDIC insurance limit is currently $250,000 per covered account. There is no need for retail depositors to panic, or to move away from whatever bank has provided them with great service.

The banking industry itself must change though, and there must be more differentiation between the treatment of banks with differing financial conditions. The good banks must be allowed to grow and attract more capital, and the less healthy banks should be either recapitalized, purchased by a stronger bank, or closed.

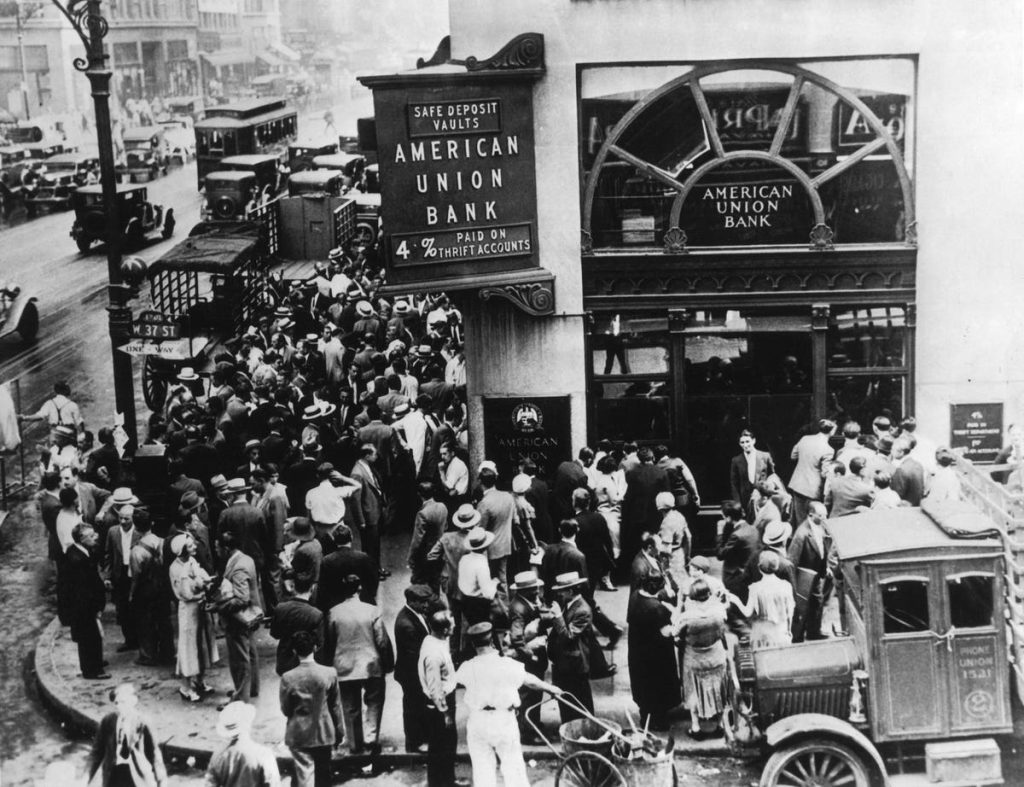

The least healthy banks are zombie institutions. The zombie banks are identified when the mark-to-market value of all assets is so much less than the value of all the liabilities such that the equity is not large enough to make up the difference. Put another way, on a mark-to-market basis, zombie banks are worth less than zero.

Zombie banks exist because accounting and regulatory capital rules permit banks under certain circumstances to disregard the current valuation of certain assets in favor of historical values. As a consequence, in periods such as the recent sharp increase in interest rates, banks can have a mark-to-market value very different and much lower than that reported by accounting and regulatory calculations. Matt Levine has an article on Bloomberg on how these situations may arise.

Retail customers should not be overly concerned about the zombie banks: they are neither a brand-new phenomenon nor a threat to their deposits. The U.S. regulatory system and the FDIC insurance protection ensure that retail customers are protected.

In January 2023, in the Forbes article, “Silvergate Shows What May Happen If Community Banking Crisis Arrives” a December research report from PNC Financial Institutions Group was referenced that identified thirty banks that were zombies, and a total of 500 banks that required further analysis. The weakness of certain banks was known for some time, and perhaps one confusing element was the lack of market reaction for those potentially troubled banks.

A zombie bank can continue to operate indefinitely, or at least until there is an event that necessitates the sale of the assets with unrecognized losses. It is far too simplistic to claim that such an event precipitated the failure of Silicon Valley Bank, but it certainly was a contributory factor.

Instability in any regulated banking institution is never a good thing, but perhaps the market pressure on the equity prices of the weaker banks and the support of the stronger banks is not all bad. The banks that are prudently and profitably managed should be encouraged to thrive, and the weaker banks should be under pressure to take corrective action. There are roughly 4,500 institutions insured by the FDIC, and a little pruning of the group may be best for the entire industry.

Read the full article here