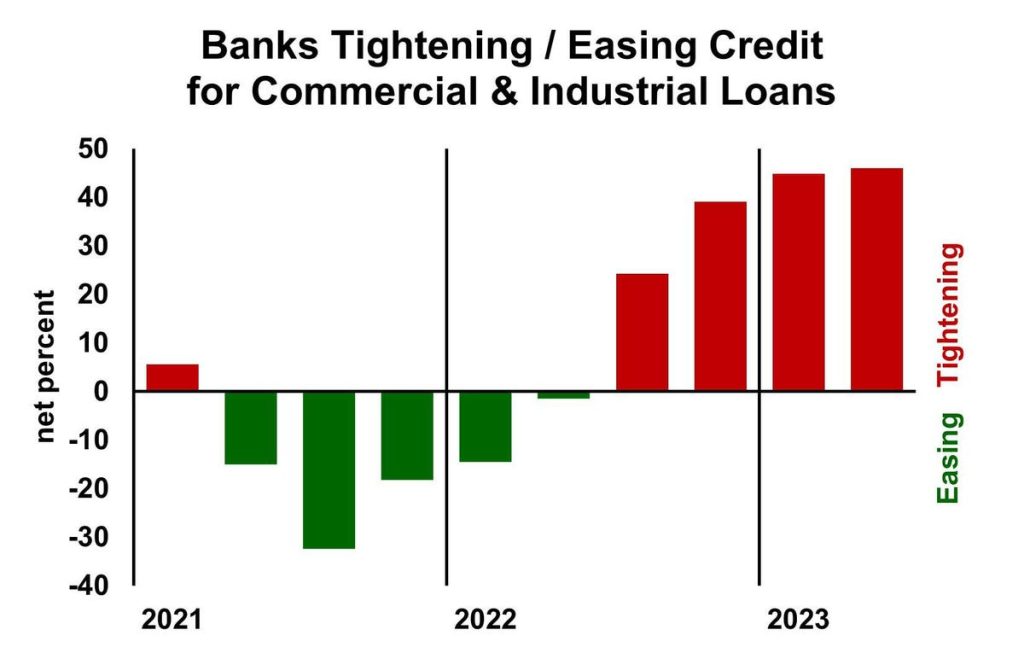

Banks are tightening credit standards for business loans, according to the Federal Reserve’s quarterly survey of senior lending officers. That true for large and medium-sized banks (shown in the chart above) as well as for small banks. The interest rates on business loans are rising relative to the banks’ cost of funds. Bankers also reported lower loan demand.

Small business owners as well as corporate executive should talk to bankers regularly, even if they are not borrowing money currently. The conversation should go beyond the banker pitching the institution as a great partner. Instead, business owners should understand where their company stands relative to the bank’s credit standards. Whether or not the company currently has a loan with the bank, knowing whether they would qualify for a loan now or in the future will help the company’s planning.

Questions that businesses with loans should ask their banker

1. Has the bank changed its credit standards in a way that would impact the credit-worthiness of our business?

2. If we don’t meet the new credit standards, what options do we have? Will additional information or collateral help?

3. Do you know of other financing options that would be appropriate for us?

4. If a recession hurts our sales and profit, at what point would the bank terminate our credit?

5. Do you have any ideas of how we could bolster our creditworthiness now so that we are better prepared for a recession?

That last question is the most important, but don’t expect a precise answer. Banks look at a variety of factors and cannot give a one-dimensional answer to the question. But a good banker can give the client a sense of how bad things would have to go before the bank worries. Some companies now have a substantial cushion, but others are skating on thin ice already. And unfortunately, many business owners don’t know how thin their ice is.

Some business owners are hesitant to mention the possibility of trouble, but that’s unreasonable. Every banker knows that recessions hurt companies. Every banker will be happy that a customer is considering the possibility of a recession and what steps will provide resiliency.

Questions that businesses without loans should ask their banker

Businesses that do not currently borrow will benefit from an idea of whether they would be bankable if a good deal came up. Suppose, for example, that a competitor had health problems and needed to sell the business. Or suppose that a new opportunity arose that would require a major capital investment. Or imagine that a flood imposes a short-run hardship on an otherwise healthy business. These situations arise and a wise owner is ready for them. Here are good questions for companies that are not currently borrowing money from their bank:

1. If we wanted a loan today, would the bank be likely to fund it? (The question probably will require a purpose for the hypothetical loan, such as to buy equipment, finance receivables or acquire another company.)

2. What loan purposes would the bank most favor?

3. How far is the company now from the bank’s credit standard? If credit-worthy today, how far could its finances decline before the bank would terminate the credit line? If not credit-worthy today, what would have to improve to become credit-worthy?

4. What changes could the company make to improve the bank’s view of its credit-worthiness?

The banker will likely want to see the company’s cash flow relative to its current debt service. Also important is the recent trend of sales and profit growth. Liquidity—how much of the company’s assets can quickly be turned into cash—also factors in. Collateral is important, usually in the form of accounts receivable, inventory or real estate. Credit history is also important.

Most of the time the banker will not be able to give a definitive answer, but a good loan officer will be able to help the customer understand how close to the dividing line the company sits. Some banks have automated their credit approval process to the point that the person who talks to the customer does not know what the bank’s standards are. Fortunately, plenty of banks have people who can help business owners understand the key standards the bank holds.

Business borrowing in recessions

Recession provide good buying opportunities for companies that have good financials. Some other businesses will be available for purchase, and others will put land and used equipment up for sale. Some brand new equipment may become available if a buyer has rescinded an order. Having good credit will help a company take advantage of these opportunities. And having conversations with bankers early will speed up the process.

Read the full article here