E

very year for the Fintech 50, our annual list of the most innovative fintech startups, we evaluate hundreds of new companies that have never earned a spot before. Despite the rough patch many fintech entrepreneurs are going through with abundant layoffs and shrinking valuations, some standout founders led their companies to impressive innovation and growth in 2022.

On this year’s Fintech 50 (our eighth annual), 19 honorees were newcomers. Profiled below are the entrepreneurs behind a half-dozen of those first-timers. The six work across a diverse spectrum of fintech categories and hail from just as wide a range of backgrounds. One started her venture (a payments company for independent beauty businesses) in her mid-20s after just a few years as a Goldman Sachs alternative investments analyst. Another is a former private equity executive who previously led the lending business at Square (now Block) and decided in her early 50s to buy a bank in Kansas City and turn it into a service provider to other fintechs and large companies.

A Kenyan-born software engineer, still just 30, has built a startup that lets other companies offer wealth management services to ordinary investors. Another first-timer is a serial entrepreneur who sold an ecommerce startup to Groupon in 2012 before launching a digital-only home insurance company that was recently valued at $875 million.

Here are six founders who made their debut on our Fintech 50 2023 list:

Danielle Cohen-Shohet, 33

Founder and CEO, GlossGenius

As an undergraduate economics major at Princeton, Cohen-Shohet had an unlikely side hustle as a makeup artist. After graduation, she took a job in finance at Goldman Sachs but kept thinking about the beauty business. In 2016, she founded an appointment booking and payments software company geared to the needs of independent beauty businesses and freelancers. GlossGenius has raised $44 million (most recently in June 2022 at a $360 million valuation), has more than 50,000 active customers and is now processing over $2 billion a year in transactions. Cohen-Shohet’s twin, Leah, also a Princeton economics grad, is chief business officer.

Sanjay Desai, 49

Cofounder and CEO, Mudflap

As chief product officer of Trucker Path, Desai helped build a navigation and load- management program for truckers. But the Stanford MBA and a coworker saw another opening—for an app that would link owner- operators and small fleets with truck stops ready to offer them fuel discounts. In 2016, they cofounded Mudflap, which now has 500,000 truckers using its free app. In addition to collecting transaction fees from its fuel marketplace, Mudflap last year rolled out its own Visa debit card offering added discounts— and enabling it to collect fees on customers’ purchases. It has raised $85 million, most recently at a $700 million valuation in July 2022.

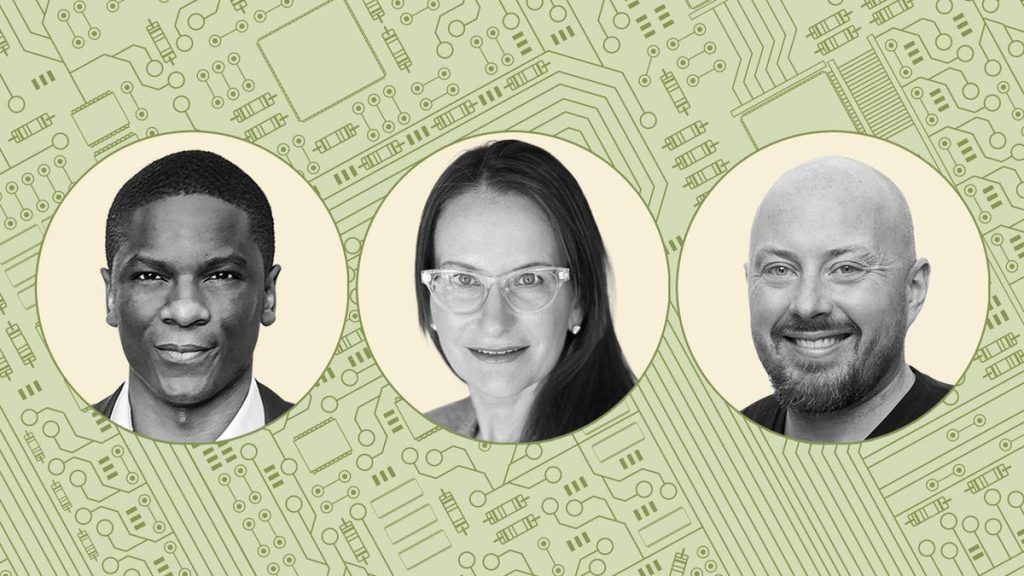

David Dindi, 30

Cofounder and CEO, Atomic Invest

A Stanford-educated software and AI engineer turned quantitative money manager, Kenya-born Dindi teamed up with former classmates in 2020 to build a digital platform enabling fintechs, banks and credit unions to provide a range of consumer services including money market funds, ESG investing and tax-loss harvesting. Atomic’s direct indexing services allow even the smallest investors to own portfolios of fractional shares. So far, it has signed up nearly 50 customers; fintech startup Lilly, for example, uses Atomic to convert credit card rewards into Roth IRAs. Atomic raised $25 million in November 2021 in a Series A led by QED Investors and Anthemis.

Hussein Fazal, 41

Cofounder and CEO, Super.com

In 2008, Canadian Fazal quit a tech job to cofound AdParlor, which built marketing campaigns to run on Facebook. He sold it in 2011, stayed on as CEO for a few years and then in 2016 launched Snapcommerce, a discount hotel reservation service recently valued at nearly $1 billion. Last October, he changed its name to Super.com and branched into financial services with SuperCash, a secured credit card that offers cash-back rewards and reports payments to credit bureaus. When San Francisco–based Super.com’s millions of users book a reservation, they’re prompted to sign up for SuperCash. So far, 50,000 have.

Sean Harper, 42

Cofounder and CEO, Kin Insurance

In 2009, Harper launched an e-commmerce startup while earning an MBA at the University of Chicago. It was bought in 2012 by Groupon, and he stayed on for a few years. In 2016, he cofounded Kin as a digital-first home insurer. It now has 100,000 policyholders but is available in just six states, which keeps underwriting and marketing costs low. He structured the insurer as a co-op owned by policyholders, with Kin taking 32% of premiums as a management fee; it more than doubled revenue in 2022 to $68 million. After canceling a plan to go public in a SPAC deal that valued it at $1 billion, Kin recently raised $109 million at an $875 million valuation.

Jacqueline Reses, 53

Cofounder and CEO, Lead Bank

A former executive at Yahoo and the private equity firm Apax, Wharton grad Reses spent five years, from 2016 to 2021, building up banking services at Square (now Block). Last August, Reses, who appears on our 2023 ranking of America’s Most Successful Businesswomen with a net worth of $390 million (see page 64), teamed up with other ex-Square execs and investors—including Ribbit and Andreessen Horowitz—to buy Kansas City–based Lead Bank. She’s expanding its services to other fintechs; it helps credit card startup Ramp lend money to businesses and Unchained Capital make loans collateralized with bitcoin. A secondary sale in April valued Lead at $450 million.

MORE FROM FORBES

Read the full article here