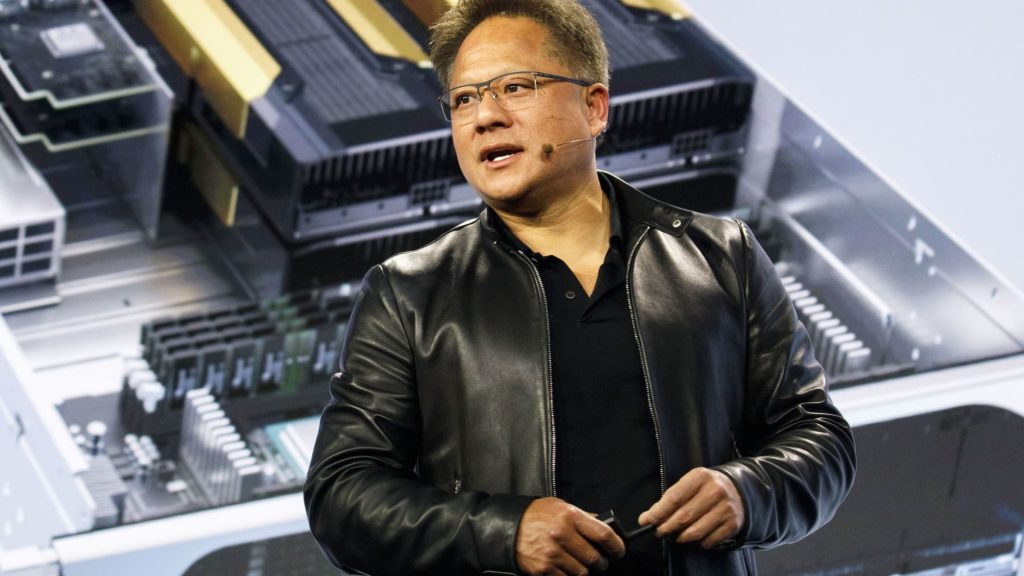

Fears of an earnings recession this quarter were overblown: Once again, companies largely exceeded expectations. One obvious reason for that outperformance is that many forecasts were low — for good reason. There was just so much uncertainty, including China’s post-Covid-restrictions reopening play, the debt limit showdown in Washington and the Federal Reserve’s ongoing battle with inflation, that analysts lacked any real clarity on results and forecasts. It was much easier to lay out the bear case than the bull case. That’s not to discount the performances. Many management teams proved to be nimble in a very uncertain environment and demonstrated an ability to rapidly raise costs to protect margins. Built-up savings also helped, allowing consumers to absorb the passed-through costs. As a result, about 78% of S & P 500 companies reported better-than-expected earnings results, according to FactSet. As always, we’re wrapping up the season with a review of all the releases from our holdings. These quarterly report cards are not the end-all, be-all for analysis. But we believe stock prices ultimately follow the underlying business fundamentals of companies. So, as we wrap up the current quarter of 2023 and look ahead to the third, here’s a rundown of how we rank first-quarter releases from all 34 companies in the Club portfolio. Similar to prior quarters, we grouped company results into one of four categories. The companies in each category are listed in alphabetical order. The Great The Good The Not So Bad The Ugly The Great Despite ongoing macroeconomic uncertainty, Apple (AAPL) posted better-than-expected results for the March quarter, bouncing back nicely from the supply-constrained December quarter. The installed base of active devices continued to expand to more than 2 billion. Moreover, management’s current quarter gross margins forecast of between 44% and 44.5% came in ahead of expectations. Emerson Electric (EMR) reported a much-needed beat and raise this time around, reaffirming our confidence in management following an unsteady start to the year that weighed heavily on its stock. We saw solid growth across the board and operating leverage that led to stronger-than-expected profits. Halliburton (HAL) beat sales and earnings estimates with better-than-expected results in all four geographic segments. Moreover, the company continues to expect customer spending to grow in 2023 and beyond. In North America, specifically, management reiterated that spending is on track to grow at least 15% this year. Results from Linde (LIN) were so good that we had no choice but to increase our price target on the release. Though the bar was high, with shares trading into the print near all-time highs, management did not disappoint. Though sales came up short of expectations, earnings, operating margin, and return on capital all notched new record highs in a tough economy. Despite a miss on earnings, the earnings report from Eli Lilly (LLY) is deserving of its top ranking due to an increase in management’s full-year forecast for sales and earnings. We also saw strong sales of key drug Mounjaro along with positive updates for its potential as a weight loss medication. Meta Platforms (META) reported a very strong first quarter as management appears to be adeptly balancing cost-optimization initiatives with artificial intelligence (AI) investments and driving better engagement than ever before. Compounding the strong results, management guided for current quarter sales to be comfortably ahead of expectations while also (again) downwardly revising its full-year-expense outlook. Another very strong quarter for Microsoft (MSFT), with better-than-expected results in all operating segments, plus cloud platform Azure had an upside surprise in its growth rate, arguably the most important metric in Microsoft’s earnings releases.. On top of the strong results, Microsoft guided above expectations for the current quarter. Nvidia (NVDA) quite likely had the best results of the entire earnings season. Not because the company beat expectations on the top and bottom lines, driven by strong data center sales, but because management’s outlook for the current quarter was dropping to the point of forcing analysts to raise consensus earnings numbers for the second quarter by about 80% and for the full year by about 57%. As a result, shares jumped 25% while the valuation on forward earnings contracted . A beat for Palo Alto Networks (PANW), with total billings that outpaced analyst forecasts. Better yet, the strong report included a positive outlook from management. Taken together, the results support the view that customers are consolidating their cybersecurity budgets around platforms that can offer an all-encompassing solution for security. Procter & Gamble (PG) delivered better-than-expected results and an increase in management’s full-year forecast for organic sales growth. Additionally, management raised the low end of the share repurchase plans for the full year. Salesforce (CRM) reported an earnings beat and a guide up on full-year GAAP and non-GAAP operating margin and earnings projections. (GAAP stands for generally accepted accounting principles.) Current quarter guidance also came in ahead of expectations. We are impressed with how efficient the company has become in such a short period of time. We may have a chance to increase our position since shares inexplicably sold off on the release Wednesday after the bell. The Good Advanced Micro Devices (AMD) outpaced expectations on both the top and bottom lines in the first quarter, thanks to strong performance in the gaming and embedded (processors for industrial and commercial applications) segments of its business. However, this strength was partially offset by weakness in its data center and PC segments. Additionally, while the report was solid, we rate the release as Good (not Great) due to the simple fact that the rebound in growth appears to be a second-half 2023 story. Amazon (AMZN) put up strong first-quarter results and beat Street expectations for operating income, a key focus metric for investors. Strong as the first quarter was, however, the company’s view of the current quarter was more mixed. Additionally, Amazon must do more to rein in costs in a slower growth environment. Progress has been made, but there is more work to be done. We remain patient investors on the expectation that management will find religion. Caterpillar (CAT) posted a blowout first quarter. However, concerns about whether those results were as good as it will get for the machinery maker continues to weigh on shares. We don’t agree with that view — even as we concede the backlog could be better. Management sounded upbeat about demand trends and we remain steadfast in our view that the billions of dollars earmarked by the government for infrastructure projects will prolong the cycle. Costco (COST) results were a bit light versus expectations but were better than they appeared at first glance when accounting for a non-recurring charge of $0.50 per share, primarily due to the discontinuation of its charter shipping activities. Though this remains a difficult period for retailers, Costco continues to outperform its peers thanks to the lowest prices on quality items it offers to customers. Coterra Energy (CTRA) reported better-than-expected results, compounded by strong cash flow generation. Additionally, guidance for both the second quarter and full year 2023 was largely in line with expectations. Ford (F) posted solid results , quickly bouncing back from some of the self-inflicted wounds that plagued the fourth quarter of last year. Management demonstrated an ability to navigate what has become a trickier macroeconomic environment, filled with uncertainties ranging from the availability of credit to a potential pricing war with electric-vehicle maker Tesla (TSLA). Alphabet (GOOGL) needed a strong report and that’s exactly what we got . Headline beats were accompanied by a better-than-expected operating margin, strong cash flows and lower-than-expected traffic acquisition costs. The only thing keeping this from being a great quarter is that further cost rationalization is needed. GE Healthcare (GEHC) reported solid results with its first-quarter earnings release as sales and earnings outpaced expectations. However, investors seem to have taken issue that the beat was not met with a raise to management’s full-year forecast. That pullback after an overall good quarter provided the opportunity we needed to take a position . Honeywell (HON) kicked off 2023 with a surprisingly strong first quarter as segment profit margin expanded more than expected and organic growth nearly doubled. A mixed forward outlook prevented this from being an all-around great report. Humana (HUM) delivered mixed results as a better-than-expected benefits expense ratio resulted in the company reporting a bottom-line beat, despite lighter-than-anticipated sales. Humana also raised its sales and earnings guidance for the full year. Johnson & Johnson (JNJ) reported strong results with sales and earnings coming in ahead of expectations and strength across the company. However, management revised its outlook for pharmaceutical sales in 2025, which only added to analysts’ skepticism of management’s ability to meet forecasts. An overall strong quarter for Morgan Stanley (MS) as sales and earnings both came in ahead of expectations. Still, expenses were higher than expected, net interest income came up a bit short and we were hoping for a bit more of the firm’s return on tangible common equity, a key metric supportive of a bank’s valuation. Starbucks’ (SBUX) beat was driven by an improved operating margin and a 6% annual increase in store traffic. The ding on the quarter was management’s decision not to raise forward guidance. We can understand the disappointment of investors. At the same time, we recognize continued uncertainty about the economy in the United States and elsewhere. Wells Fargo (WFC) reported strong results thanks to driven by better-than-expected net interest margin and return on tangible common equity and efficiency ratios. On the other hand, deposits and loans came in below expectations. Looking ahead, Wells Fargo reiterated its guidance for net interest income (NII) and non-interest expenses for 2023 — welcome news given the uncertainty that’s arisen in the banking sector since that guidance was first provided. Though earnings missed the mark for casino operator Wynn Resorts (WYNN) sales came in better than expected and what really stood out was management’s commentary on the rebound taking place in Macau. During the recent Chinese New Year, “mass table drop” — the amount of cash that is deposited in a gaming table’s drop box plus cash chips purchased at the casino cage — reached 95% of 2019 Chinese New Year levels. The Not So Bad Despite reporting better-than-expected results, Danaher’s (DHR) forward guidance came in below what investors were looking for as the de-stocking of bioprocessing inventories remains a headwind. While much of that comes from larger customers, smaller customers including emerging biotechnology companies and others working on early-stage projects, are seeing a liquidity crunch following the fall of key funder Silicon Valley Bank. Disney (DIS) reported decent results that were largely in line with expectations. However, as we commented ahead of the print, this report was largely a non-event. Disney’s future earnings potential is still very promising thanks to the continued strength of theme parks and the coming profitability of streaming. But the company’s cost structure was too high coming into this year, and it will take time for management’s $5.5 billion savings plan to materialize. Pioneer Natural Resources (PXD) delivered mixed results as sales came up short while earnings were better than expected. However, what really dinged the results was a miss on realized prices and a resulting decline in free cash flow, which came in below expectations. That led to a reduced dividend payment, a key metric now that the energy complex has pivoted from production growth at all costs to cash returns to shareholders Though sales results missed, Constellation Brands (STZ) managed to deliver a beat on the bottom line thanks to a better-than-expected operating margin. Depletion results were another bright spot on the release. Looking ahead, management provided a better-than-expected earnings forecast for fiscal year 2024 and reaffirmed its disciplined approach to capital allocation. Despite the top-line miss, TJX Companies (TJX) delivered better-than-expected earnings as management demonstrated the ability to diligently control expenses. Same-store-sales (SSS) growth came in at the high end of management’s guidance range, driven by an overall increase in customer traffic and positive SSS growth in three of the four operating segments. Still, guidance came in a bit light as the operating environment remains highly uncertain. The Ugly No stranger to “The Ugly” section of our quarterly report cards, Bausch Health (BHC) tanked on its earnings release as the Xifaxan overhang continues to weigh on shares. A resolution in Xifaxan litigation along with the spinoff of the remainder of its Bausch + Lomb (BLCO) stake, which management still believes to be the correct course of action, represent the two most important future catalysts for the stock. Estee Lauder (EL) reported mixed results as sales came in above expectations while earnings per share came up short. But it was management’s outlook that made this a truly ugly report. The team noted that the post-Covid recovery for its Asia travel retail business is proving “far more volatile” and “more gradual” than management had previously expected, forcing it to materially lower the forecast for the remainder of the fiscal year. Foot Locker (FL) reported an abysmal quarter as a need to flush out elevated inventories weighed on the results. Compounding that was the combination of a concerted effort to reduce Foot Locker’s reliance on Nike (NKE), a 10% decline in tax refunds to American workers and the shutdown of the Eastbay brand. Though disappointed, we do believe that management’s turnaround strategy will transform the company into a leaner, more efficient business — with greater customer loyalty, a better omnichannel experience and improved profitability over time. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Fears of an earnings recession this quarter were overblown: Once again, companies largely exceeded expectations.

One obvious reason for that outperformance is that many forecasts were low — for good reason. There was just so much uncertainty, including China’s post-Covid-restrictions reopening play, the debt limit showdown in Washington and the Federal Reserve’s ongoing battle with inflation, that analysts lacked any real clarity on results and forecasts. It was much easier to lay out the bear case than the bull case.

That’s not to discount the performances. Many management teams proved to be nimble in a very uncertain environment and demonstrated an ability to rapidly raise costs to protect margins. Built-up savings also helped, allowing consumers to absorb the passed-through costs. As a result, about 78% of S&P 500 companies reported better-than-expected earnings results, according to FactSet.