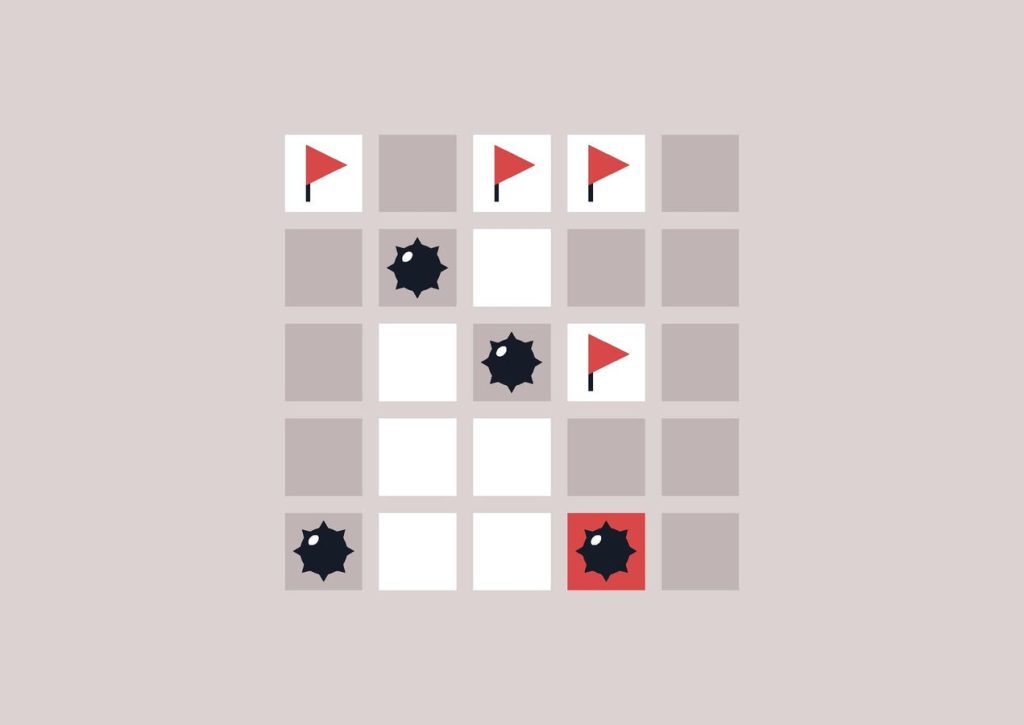

As baby boomers age and continue to live longer than any previous generation, it seems as though the more we know about what’s ahead, the better prepared we will be to face the uncertainties of being an elder. Unfortunately, there is evidence showing that most people aren’t very knowledgeable about their own aging and therefore are making some uneducated assumptions and poor choices. As a society, that leaves us in a very vulnerable position, with a high probability of encountering some devastating minefields in the very near future.

Minefield #1 – Lack of knowledge leads to bad assumptions

According to a University of Michigan national poll, only 43% of adults over 50 believe they will need long term care in the future. This finding demonstrates a lack of understanding of the aging process and the likelihood (about 65%) that they will need some kind of assistance with the activities of daily living (ADLs) as they age into their 8th 9th and 10th decades of life. This likelihood increases, of course, the older one gets.

Of course, one may get lucky and be one of those people who expire one day at 90-something on the golf course (or pickleball court) without having spent a single day of life needing help with anything. But statistically, that is highly improbable.

Minefield #2 – Lack of education leads to inadequate planning

Almost half of older adults (48%) say they do not know how to plan for their long-term care needs. Furthermore, a very low percentage of older adults have made any plans for future long-term care:

- Only 27% have designated a durable power of attorney or advance directive for medical care

- Only 24% have identified people in their lives who might serve as their caregivers

- Only 18% have made modifications to their homes to help them age safely

- Only 11% purchased long-term care insurance

- Only 7% have ever visited an assisted living facility or nursing home to get a better understanding of what they provide and how much they cost

Minefield #3 – Lack of information may lead to personal financial crisis

The majority of older adults in the poll reported that they would not be able to pay for a nursing home, home care, or assisted living. When they were asked who they assumed would pick up the tab if they need care, a very scary 62% of adults over fifty believe Medicare would cover their long-term care needs. The rest indicated that it would likely be some combination of friends, family, and paid caregivers.

Medicare does NOT cover non-medical care, which means it does not cover any kind of assistance with the activities of daily living (bathing, dressing, eating, toileting, transferring (e.g moving from a bed to a chair), and grooming).

The poll also indicated that a strong majority of older adults prefer to remain in their homes if they need assistance, believing that paid support services in their homes would be far less costly than receiving them in a supportive environment. However, that doesn’t appear to be the case. According to Genworth’s 2024 study, the annual cost of at-home care in many areas of the country is similar or exceeds that of residing in an assisted living facility. Across the country, the cost of a home health aid topped $75,000 (based on 44 hrs. per week). The annual national median cost of an assisted living community was $70,800 per year.

The implications of these findings are that Americans, as a society, are inadequately informed and ill-prepared for life as aging adults. They point to a critical need for better education and preparation.

Who can we look to for education and awareness?

Policy-makers can help raise awareness about the need for long-term planning and the resources that are available in our communities. Area Agencies on Aging, a nationwide network of county offices that are supported by funds through the Older Americans Act, can play a role as well. They could set up seminars and resource centers for adults in their jurisdiction. Additionally, there is a role for financial planners, attorneys, and senior care advisors. They must first educate themselves on these issues so they will be able to help their clients do necessary planning and budgeting for this care.

Read the full article here